An improving global economy, despite some mixed evidence

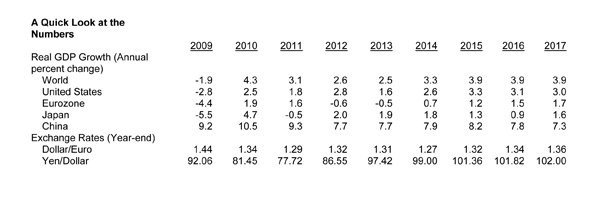

The balance of global economic data over the past month has been positive. While there is no shortage of risks (geopolitical pressures on oil prices, another round of budget fights in the United States, economic fragility in the Eurozone, and further weakness in emerging markets), the fundamentals point to a gradual acceleration in global real GDP growth from 2.5% this year to 3.3% in 2014 and 3.9% in 2015.

United States — the economy plods along. There are reasons to worry about the US recovery: volatility in oil prices, political discord in Washington, the threat to housing markets from rising long-term interest rates, and disappointing news on jobs. Yet, there are ample reasons to cheer. At 2.5%, second-quarter growth was stronger than previously estimated. Light-vehicle sales have reached a six-year high, household net worth is surging, and business confidence is improving. As the impacts of 2013 tax increases and federal budget cuts fade, US economic growth will likely strengthen.

Europe — The Eurozone economy has turned the corner, but the recovery will be neither broadly based nor strong. The mild but long Eurozone recession ended in the second quarter, as expansions in some northern economies (notably Germany and France) overshadowed smaller declines in the southern periphery. The recovery will progress — but at a very weak pace — thanks to mild inflation, monetary accommodation, pent-up demand, rising confidence, and improved competitiveness (at least in some of the crisis countries). Some of the best economic news has come from the United Kingdom, prompting another upward revision in the forecast.

Japan — Leading G7 growth, but for how long? The Japanese economy expanded at an impressive 4% annual rate in the first half of this year—the strongest pace among G7 economies. Growth has been boosted by lower real interest rates (as deflation has abated), a weaker currency, and a stock market surge. Yet, there are mounting concerns that sales tax hikes scheduled for April 2014 and October 2015 could derail the recovery, as similar tax increases did in 1997.

China — A likely second-quarter trough for growth, but what’s next? July and August data on industrial production, exports, business sentiment, and car sales all point to a gradual pickup in growth. While China has not been plagued by the recent selloff in emerging markets (thanks to heavy reliance on capital controls), its exports are vulnerable to any slowdown in the rest of Asia. The central government has shifted its policy stance and is now providing modest stimulus. Any rebound in growth will also likely be modest.

Other large emerging markets — Not a repeat of 1997, but the BRIC party is probably over. The good news for emerging markets is that the recent financial turmoil is unlikely to lead to a repeat of the emerging-market crises of the mid-to-late-1990s. Debt burdens are lower, foreign-exchange reserves are higher, exchange rates are more flexible, and banks are healthier; this is especially true of Asia. The rapid growth rates of the last decade may have been a one-time occurrence, driven by a credit boom and soaring commodity prices. While growth in these economies will rebound, the very rapid rates of the 2000s will probably not be repeated — unless these economies embark on aggressive structural reforms.